PREDICTIVE SEGMENTATION FOR SUSPICIOUS CLAIMS

REDUCE FRAUDULENT PAYOUTS AND OPERATIONAL COSTS IN THE CLAIMS HANDLING PROCESS

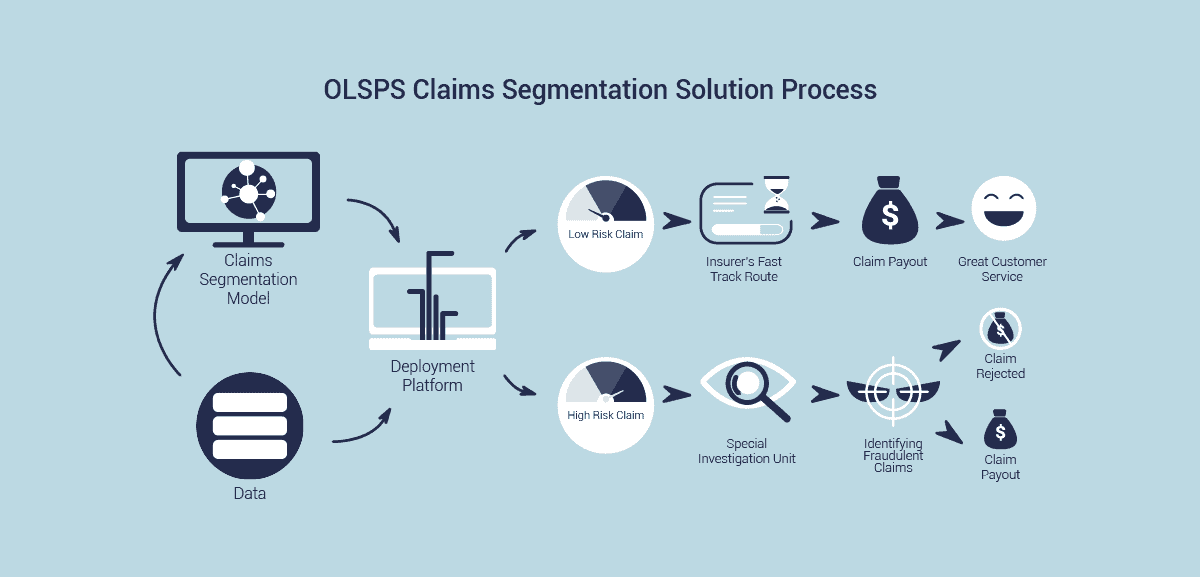

Short-term insurers want to process claims through the most appropriate, efficient and cost-effective route without increasing the incidence of fraudulent claims or the tendency for claims to be overstated. Through the use of machine learning algorithms, the solution leverages the use of an insurer’s internal data to automatically assign a risk level at the point of claim registration.

Claims are then distributed to the appropriate processing channel for settlement or further investigation. This solution can be integrated with the insurer’s existing line-of-business systems, and is fully customizable to include particular business rules that are specific to the insurer. This will ensure claims are processed subject to the insurer’s internal rules and regulations.

SOLUTION BENEFITS

Implementing the OLSPS Predictive Claims Segmentation solution optimises the insurer’s business processes both by improving the odds of a claim sent to SIU being fraudulent and by reducing/negating assessment costs on low risk claims. This results in decreased operational costs; quicker turn around times for claims processing; and a higher satisfaction from customers.

CASE STUDY

Santam, a leading short-term insurance company in South Africa, wanted to improve its service to customers by settling claims faster, and keeping premiums low. Santam worked with OLSPS to design a predictive claims segmentation solution. The solution needed to integrate seamlessly with the current Santam claims process, and allow for real-time scoring of each claim with and a fast response rate. The solution implemented by the OLSPS team:

- Enhanced Santam’s ability to detect fraud – doubling the hit-rate of the Special Investigations Unit (SIU) and saving them R 17 million within the first four months of operation.

- Improved customer service by enabling legitimate claims to be settled within an hour – more than 70 times faster than before.